The price of buying a home can be a significant burden initially.

The price of buying a home can be a significant burden initially.

However, when you have to add the additional cost of stamp duty, solicitor's fees, auctioneers costs and all the other prices to the survey, it can really sky rocket.

One of the additional costs that many people often don't take into account is the survey costs.

Unlike the stamp duty and solicitors fees, these survey costs may actually save you trouble, issues and money in the long run, which is of course something that makes them more desirable.

Still though, the price is not something to balk at you wouldn't just splash that much cash around.

There are a number of surveys on offer when buying a home.

We've split them into four categories:

- Mortgage Lenders Valuation

- Basic Survey

- Full Structural Survey

- Snag Lists

Each of these surveys has a particular use, each provides different, or slightly more in depth services and of course, each cost a different price.

Mortgage Lenders Valuations

This valuation's cost depends on the price and size of the home.

However if we are to go on estimate prices a flat worth over £50,000 would cost £100 or upwards to survey and a house worth over £200,000 about £250 or more to survey.

Obviously this price depends on the area and is a rough figure that may change depending on who you get to perform the survey, where the survey is an other variables such as the size of the home.

Basic Survey/ Home Buyer's Report

This survey will determine the basic structural integrity of a home and is a necessity on homes or buildings of over 20 years of age.

It checks the basic factors that will determine whether a home is sound structurally.

One of the good things about this survey is that if you find faults it allows you to renegotiate the home's price and therefore recoup the price of the survey, or far more than the survey in some cases.

This is an essential on most homes and offers peace of mind to those purchasing a home.

Expect to pay between £250 to £400 for a home buyer's report, with the upper end of the figure for large houses, or just a rip off for smaller ones.

Obviously prices depend on area, inflation etc and can rise and fall depending on variables.

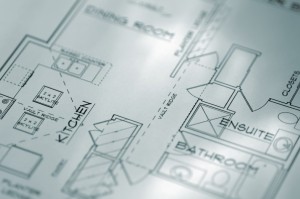

Full Structural Survey/ Home Buyer's Survey

This is the most in depth of all the home surveys and often costs a lot more than the basic survey.

This is reflected in the time and home check however.

A home buyer's report will check absolutely everything in the home from the structure to the wiring and even in specific cases thatch roofs.

These are often received for a lower cost through a mortgage lender but do beware of bias in such a case.

Also ensure you own the report and not the lender.

Expect to pay from £450 to a lot more for one of these surveys.

Snagging Reports

These reports are for new homes and will determine the quality of the workmanship in a new home and whether it meets standards.

After the snag, the inspector then consults with the contractor, who will then organise the issue to be fixed.

These reports cost upwards of £200.